If you’re looking to invest in precious metals, you’ve probably heard about rare silver rounds for sale. These beautiful pieces offer more than just silver content. They combine artistic design with investment value. Many collectors and investors want to buy rare silver rounds online because they’re easier to store than bars and more affordable than coins. But what makes them special? And how do you know you’re getting authentic pieces? This guide walks you through everything you need to know about starting your silver round collection.

What Makes Silver Rounds Different from Coins

Silver rounds look like coins. But they’re not legal tender. The U.S. Mint doesn’t produce them. Private mints create these pieces. They typically contain one troy ounce of pure silver. Some rounds feature stunning artwork. Others commemorate special events or themes.

Coins have a face value. Rounds don’t. This difference matters for pricing. Coins often carry higher premiums because of their legal tender status. Rounds stay closer to the spot price of silver. This makes them attractive to investors who want maximum silver for their money.

Silver rounds come in many designs. You’ll find everything from classic American eagles to mythical creatures. Some mints produce limited editions. These rare pieces can increase in value over time. The combination of silver content and collectible appeal makes them interesting investments.

Why Investors Choose Silver Rounds Over Other Options

Silver rounds offer several advantages. First, they’re more affordable than government-issued coins. You pay less premium over spot price. This means more actual silver for your investment dollar.

Second, they’re easier to verify than scrap silver. Reputable mints stamp their rounds with weight and purity. You can quickly check authenticity. This matters when you’re ready to sell.

Third, silver rounds are portable. You can store significant value in a small space. A roll of twenty rounds weighs just over a pound. But it represents substantial purchasing power.

Fourth, they’re liquid assets. Dealers recognize major mint brands. You can sell them quickly when needed. The market for silver rounds stays active even during economic uncertainty.

Many investors use silver rounds to diversify. They balance paper assets with physical precious metals. Silver rounds make this strategy accessible to people with modest budgets.

How to Identify Quality Silver Rounds

Not all silver rounds are created equal. Quality matters for both investment and resale value. Here’s what to look for when shopping.

Check the mint mark. Established mints have strong reputations. Their rounds command better resale prices. Look for clear stamping that shows weight and purity. Most quality rounds display “.999 fine silver” or similar markings.

Examine the strike quality. Well-made rounds show sharp details. The design should be clear across the entire surface. Poor strikes indicate rushed production or worn dies.

Feel the weight. A one-ounce round should feel substantial. If it seems light, something’s wrong. Authentic silver has a distinct heft.

Consider the design. Limited edition rounds with artistic merit often appreciate beyond their silver content. But common designs stay closer to spot price. Choose based on your investment goals.

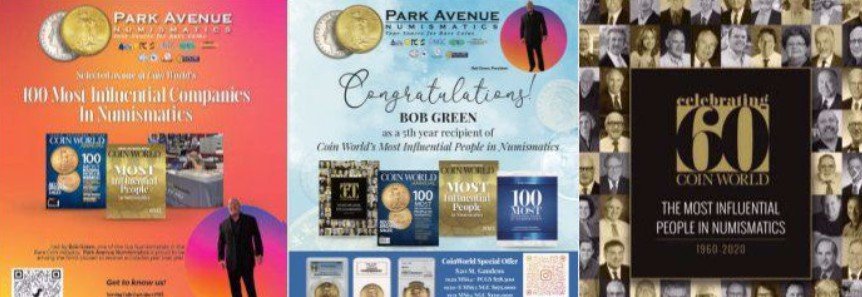

Research the seller. Reputable dealers provide certificates of authenticity. They stand behind their products. Park Avenue Numismatics has built a reputation for quality and customer service in the precious metals market. They offer authenticated silver rounds with detailed product information.

Where Smart Collectors Find Rare Silver Rounds

Finding quality silver rounds requires knowing where to look. Online dealers offer convenience and selection. You can compare prices easily. But you need to verify the dealer’s reputation first.

Local coin shops provide hands-on inspection. You can examine rounds before buying. This helps when you’re learning to spot quality. Building relationships with local dealers can lead to early access to rare pieces.

Estate sales sometimes yield unexpected finds. Silver rounds from closed collections may sell below market value. But you need knowledge to spot good deals and avoid counterfeits.

Auctions can offer opportunities. Both online and live auctions feature silver rounds. Research comparable sales before bidding. Set a maximum price and stick to it.

Park Avenue Numismatics specializes in precious metals for collectors and investors. They maintain an extensive inventory of silver rounds from respected mints. Their website provides detailed descriptions and clear pricing. Customer reviews highlight their reliable shipping and authentic products.

Starting Your Silver Round Collection the Right Way

Begin with a clear goal. Are you investing for wealth preservation? Or building a collection of beautiful pieces? Your goal shapes your buying strategy.

Start small. Buy a few rounds to learn the market. Handle them. Study the designs. This hands-on experience builds confidence.

Set a budget. Decide how much you’ll invest monthly or quarterly. Consistent buying smooths out price fluctuations. You’ll acquire silver at various price points.

Focus on recognized mints initially. Names like Sunshine Minting, Golden State Mint, and others produce widely accepted rounds. These trade easily when you’re ready to sell.

Keep detailed records. Note purchase dates, prices, and sources. This documentation helps track your investment performance. It also provides proof of ownership for insurance purposes.

Store your rounds properly. Use protective capsules to prevent scratches. Keep them in a secure location. Consider a safe deposit box for large collections.

Educate yourself continuously. Silver markets change. New designs appear regularly. Stay informed about market trends and mint releases.

Understanding Silver Market Dynamics

Silver prices fluctuate based on multiple factors. Industrial demand affects prices significantly. Silver has uses in electronics, solar panels, and medical applications. When industries grow, silver demand increases.

Economic uncertainty often drives silver prices up. Investors seek safe havens during market turmoil. Physical silver provides tangible wealth storage.

Currency values impact precious metals. When the dollar weakens, silver often strengthens. This inverse relationship makes silver an inflation hedge.

Supply and demand fundamentals matter. Mining production, recycling rates, and investment demand all influence prices. Following these trends helps time your purchases.

Don’t try to predict exact price bottoms. Instead, buy consistently over time. This strategy reduces timing risk. You’ll average your cost across different price levels.

Avoiding Common Mistakes When Buying Silver Rounds

New buyers often overpay for common rounds. Research current premiums before purchasing. Know the spot price of silver. Understand reasonable markups.

Some people buy without verifying authenticity. Counterfeit silver exists. Learn basic testing methods. Work with established dealers who guarantee their products.

Poor storage damages silver rounds. Exposure to air causes tarnishing. Rough handling creates scratches. These issues reduce resale value.

Emotional buying leads to poor decisions. A beautiful design might command high premiums. But will the market support that premium later? Balance aesthetic appeal with investment value.

Neglecting seller research causes problems. Some online dealers have poor reputations. Check reviews before ordering. Verify business credentials.

Selling too quickly can hurt returns. Transaction costs eat into profits on short-term sales. Plan to hold silver rounds for several years minimum.

The Role of Trusted Dealers in Your Success

Working with reputable dealers makes a huge difference. They provide authentic products. They offer fair prices. They stand behind their sales.

Park Avenue Numismatics exemplifies the trusted dealer model. They’ve served collectors and investors for years. Their product selection includes rounds from major mints. They provide clear photos and descriptions for each item. Customer service receives consistently positive feedback.

Good dealers educate their customers. They explain product features. They discuss market conditions honestly. This transparency builds lasting relationships.

Established dealers have secure shipping procedures. They insure packages fully. They track shipments carefully. Your investment arrives safely.

Return policies matter. Reputable dealers accept returns on defective products. They resolve disputes fairly. This protection provides peace of mind.

Making Silver Rounds Part of Your Financial Strategy

Silver rounds fit into diversified portfolios. Financial advisors often recommend holding five to ten percent of assets in precious metals. Silver rounds make this allocation affordable.

They provide insurance against currency devaluation. Paper money loses purchasing power over time. Silver maintains intrinsic value.

Silver rounds offer liquidity without stock market exposure. You can convert them to cash quickly. But they’re not tied to corporate performance or market sentiment.

Consider silver rounds as long-term holdings. Short-term price swings shouldn’t trigger sales. The goal is wealth preservation across years or decades.

Balance silver holdings with other investments. Stocks, bonds, real estate, and precious metals each play different roles. Diversification reduces overall portfolio risk.

Final Thoughts on Building Your Silver Collection

Investing in silver rounds combines practical wealth preservation with the joy of collecting. Each piece represents real value. Many feature beautiful designs worth admiring.

Start your journey with research and education. Learn to identify quality. Understand pricing structures. Connect with reputable dealers.

Buy consistently rather than trying to time the market. Build your collection gradually. Enjoy the process of acquisition and discovery.

Store your rounds securely and maintain careful records. Treat them as the valuable assets they are.

Whether you’re protecting wealth or building a collection, silver rounds offer accessible entry into precious metals investing. Their combination of affordability, liquidity, and tangible value makes them worth considering for your financial future.

The market for quality silver rounds remains strong. Collectors and investors worldwide recognize their appeal. With knowledge and careful selection, you can build a collection that serves both financial and personal goals.