Looking to diversify your investment portfolio with rare coins and precious metals? Whether you’re interested in historical pieces or modern bullion, understanding what makes certain items valuable can save you money and help you make smart decisions. If you want to buy half cents or buy rare platinum bullion online, you need to know what sets quality dealers apart from the rest. This guide walks you through everything you need to know about these two distinct investment categories and how to approach them with confidence.

Understanding the Appeal of Half Cents in Numismatics

Half cents hold a special place in American coin collecting history. These coins were minted from 1793 to 1857 and represent some of the earliest currency produced by the United States Mint. For collectors and investors, these pieces offer something unique. They’re not just coins. They’re pieces of American history that you can hold in your hand.

The value of half cents goes beyond their face value. Many factors determine what a half cent is worth today. The year it was minted matters a lot. The condition of the coin plays a huge role too. Coins that have been professionally graded by services like PCGS or NGC typically command higher prices because buyers know exactly what they’re getting. Rarity is another critical factor. Some years saw very limited production runs, making those coins especially desirable to serious collectors.

When you explore options to buy half cents, you’ll encounter several design types. The Liberty Cap Half Cent from 1793 to 1797 is among the earliest. The Draped Bust Half Cent came next, running from 1800 to 1808. Then there’s the Classic Head Half Cent from 1809 to 1836, followed by the Braided Hair Half Cent from 1840 to 1857. Each design tells its own story about American coin production during that period.

What Makes Platinum Bullion a Strategic Investment?

Platinum occupies an interesting position in the precious metals market. It’s rarer than gold and silver, yet it often trades at different price points depending on market conditions. Industrial demand for platinum remains strong because of its use in automotive catalytic converters and other manufacturing applications. This industrial demand creates a different dynamic compared to gold, which is primarily an investment and jewelry metal.

When you buy rare platinum bullion online, you’re typically choosing between coins and bars. Platinum American Eagles are the most recognized platinum coins in the United States. These coins contain one troy ounce of .9995 fine platinum and feature changing reverse designs that make them interesting to collectors. The obverse shows the Statue of Liberty. Half-ounce, quarter-ounce, and tenth-ounce versions also exist for investors who want smaller denominations.

Platinum bars offer another investment avenue. Companies like PAMP Suisse produce platinum bars with distinctive designs and secure packaging. These bars come in various weights, with one-ounce bars being the most popular. The advantage of bars is that they sometimes carry lower premiums over spot price compared to coins. However, coins may be easier to sell when you decide to liquidate your holdings because they’re more widely recognized.

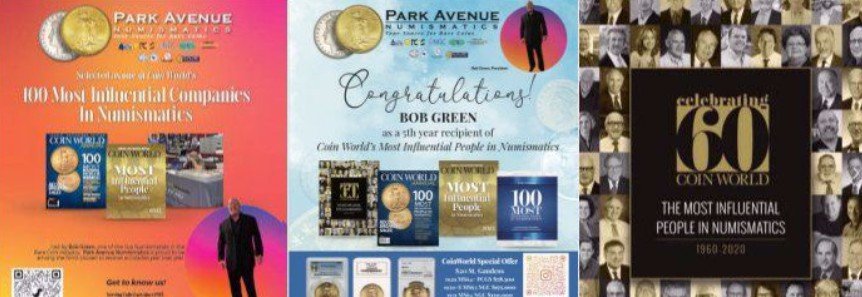

Introducing Park Avenue Numismatics

Park Avenue Numismatics has been serving collectors and investors since 1988. With over 35 years of experience in the rare coin and precious metals industry, they specialize in high-end rarities for collectors and investors alike. Their knowledgeable staff attends major shows and auctions, providing outstanding want list services and auction representation to help clients acquire the best coins available on the market.

Evaluating Condition and Grading Standards

Condition determines value more than almost any other factor when dealing with collectible coins. A half cent in mint state condition can be worth hundreds or thousands of times more than the same coin in poor condition. This is where professional grading services become essential. PCGS and NGC are the two most respected grading companies in the numismatic industry. They use a 70-point scale, with higher numbers indicating better condition.

Understanding what each grade means helps you make informed decisions. Coins graded MS-60 through MS-70 are mint state coins that never circulated. MS-65 is considered gem quality. MS-67 and above are exceptional specimens that command premium prices. For older coins like half cents, even lower grades can be valuable because so few examples survive in high grade.

Circulated coins receive grades from About Good (AG-3) up to About Uncirculated (AU-58). A coin graded VF-20 or VF-30 shows moderate wear but retains most of its design details. These mid-grade coins often represent good value for collectors who want attractive examples without paying top dollar for mint state pieces.

Pricing Factors for Half Cents and Platinum

The market for half cents varies significantly based on date and condition. Common dates in average condition might sell for a few hundred dollars. Key dates or high-grade specimens can reach five figures or more. Recent auction results show that a mint state half cent from a rare year can exceed ten thousand dollars. For collectors just starting out, focusing on more affordable examples makes sense while you learn about the series.

Platinum pricing works differently. The spot price of platinum fluctuates daily based on global supply and demand. Premiums over spot price depend on the product. Coins typically carry higher premiums than bars because of their collectible nature and legal tender status. Market conditions also affect premiums. When demand is high, premiums increase. When the market softens, premiums may compress.

Smart investors track platinum spot prices and compare premiums from different dealers. Park Avenue Numismatics updates their pricing regularly to reflect current market conditions. This transparency helps buyers make decisions based on real-time information rather than outdated quotes.

Building a Balanced Collection Strategy

Diversification matters whether you’re collecting coins or investing in precious metals. For half cents, consider building a type set that includes one example of each major design. This approach gives you historical breadth without requiring you to collect every date. You can always add more dates within a particular series later if you develop a special interest in that period.

With platinum bullion, some investors prefer sticking with recognized coins like American Eagles. Others mix coins and bars to balance collectibility with lower premiums. Your strategy should reflect your goals. Are you primarily interested in the investment potential of platinum as a metal? Focus on bars with low premiums. Do you enjoy the numismatic aspect? Platinum Eagles with varying designs might suit you better.

Park Avenue Numismatics offers both rare coins and bullion products, making it convenient to build a diversified portfolio from one trusted source. Their expertise in both areas means you get knowledgeable guidance regardless of whether you’re interested in 200-year-old copper coins or modern platinum bullion.

Authentication and Avoiding Counterfeits

The collectibles market unfortunately attracts counterfeiters. Half cents and other early American coins have been reproduced for years, sometimes as novelties and sometimes with intent to deceive. Buying certified coins from reputable dealers provides protection. PCGS and NGC authenticate coins before grading them, so a slabbed coin from these services is genuine.

Platinum bullion faces different authentication challenges. Counterfeiters sometimes produce bars or coins that look genuine but contain less platinum than claimed or none at all. Weight and dimension testing can catch some fakes. More sophisticated testing methods examine metal composition. Reputable dealers test their inventory and stand behind what they sell.

When you work with established dealers who have been in business for decades, you benefit from their reputation and expertise. They have more to lose from selling questionable items than they could ever gain. Park Avenue Numismatics has built their business over 35 years by maintaining high standards and treating customers fairly.

Storage and Security Considerations

Proper storage protects your investment. Half cents and other collectible coins should never be cleaned or handled roughly. Copper reacts with oils and chemicals, so handling coins by their edges is important. Certified coins come in sealed holders that should remain unopened. These holders protect the coin and preserve its grade.

For uncertified coins, archival-quality holders made from inert materials prevent damage. Some collectors use albums or boxes designed specifically for coin storage. Whatever method you choose, keeping coins away from moisture and extreme temperatures is essential. Safe deposit boxes at banks provide secure storage for valuable coins.

Platinum bullion requires similar care. While platinum is more chemically stable than copper, proper storage still matters. The original packaging from reputable mints includes security features that add value, so keeping coins in their original holders makes sense unless you need to verify authenticity.

Home safes offer convenience but require good quality. Fireproof safes rated for paper don’t necessarily protect metals adequately because they may allow interior temperatures high enough to damage holders or documentation. For significant holdings, professional vault storage through a dealer or depository provides maximum security with insurance coverage.

The Role of Market Timing

Precious metals markets cycle through periods of strength and weakness. Platinum has historically traded at a premium to gold, though in recent years it has sometimes traded below gold prices. These cycles create opportunities. Some investors buy platinum when it’s relatively undervalued compared to gold, betting on a return to historical relationships.

The rare coin market also experiences cycles, though they don’t always align with precious metals prices. Numismatic value depends on collector demand, which can remain strong even when metal prices decline. This distinction makes rare coins like half cents partially insulated from short-term metal price swings.

Trying to time either market perfectly is difficult. Many successful collectors and investors follow a strategy of regular purchases regardless of short-term price movements. This approach, called dollar-cost averaging, means you buy at various price points and avoid the risk of investing everything at a market peak.

Tax Considerations and Reporting

Investment in precious metals and collectibles has tax implications. The IRS classifies precious metals and collectible coins as capital assets. Gains from selling these items are generally taxed as collectibles, with a maximum federal rate higher than the rate for most stocks. Holding period matters too. Items held less than one year face short-term capital gains rates based on your ordinary income tax bracket.

Dealers who buy more than certain amounts of gold, silver, or platinum bullion from you must report the transaction to the IRS on Form 1099-B. Requirements vary by product and quantity. Rare coins generally don’t trigger these reporting requirements unless sold in very large quantities. Consulting with a tax professional who understands precious metals and collectibles helps ensure you comply with reporting requirements and structure transactions efficiently.

State laws add another layer. Some states exempt precious metals and coins from sales tax when they meet certain criteria. Others tax these purchases like any retail transaction. Before making large purchases, understanding your state’s approach can save you money.

Making Your First Purchase with Confidence

Starting your collection or investment portfolio doesn’t require huge amounts of money. Many half cents in mid-grade condition are affordable for beginning collectors. Smaller platinum products like tenth-ounce coins or gram bars allow you to enter the platinum market without major capital outlay. As you gain experience and confidence, you can expand your holdings.

Working with established dealers like Park Avenue Numismatics simplifies the process. Their staff can answer questions, explain grading standards, and help you understand what you’re buying. They maintain extensive inventory across various price points, so whether you’re looking for an affordable entry-level half cent or a premium platinum coin, options exist.

Before making any purchase, do your research. Learn about the specific items that interest you. Compare prices from multiple sources. Read dealer reviews and check credentials with organizations like the Professional Numismatists Guild. The combination of self-education and working with reputable professionals gives you the best foundation for success in numismatics and precious metals investing.

Verdict: Why These Investments Matter

Historical coins like half cents connect us to the past while offering investment potential. They represent tangible history you can hold and examine. For collectors, the satisfaction of owning these pieces goes beyond financial considerations. For investors, they provide an alternative asset that doesn’t correlate perfectly with stocks and bonds.

Platinum bullion offers different benefits. It’s a pure precious metal play backed by industrial demand. The rarity of platinum compared to gold and silver creates interesting market dynamics. For those building precious metals portfolios, including platinum alongside gold and silver provides diversification within the metals sector itself.

Whether you choose to buy half cents for their historical significance or buy rare platinum bullion online for metal exposure, success comes from education and dealing with trustworthy sources. The market rewards patience and knowledge. Take time to learn. Ask questions. Start small if you’re uncertain. As your understanding grows, so will your confidence in making larger commitments. The combination of historical coins and modern bullion can create a balanced approach to alternative investments that serves you well for years to come.