Precious metals have protected wealth for thousands of years. Today, you can buy gold bullion bars online from your home computer. You can also buy rare silver coins online with just a few clicks. But is it safe? How do you know you’re getting the real deal? This guide walks you through everything you need to know before making your first purchase.

Gold and silver remain popular investments during uncertain times. People trust them when stock markets drop. They hold value when paper money doesn’t. The internet has made buying these metals easier than ever. You no longer need to visit multiple coin shops in person. But online shopping comes with its own challenges. You need to know who to trust.

Understanding Gold Bullion Bars

Gold bullion bars are pure gold shaped into rectangular blocks. They come in different sizes. You can find small one-gram bars that fit in your pocket. You can also find large kilogram bars worth thousands of dollars.

Most bars contain 99.9% pure gold. Some reach 99.99% purity. The weight is stamped right on the bar. You’ll also see the manufacturer’s mark and a serial number. These features help verify authenticity.

Bars cost less per ounce than coins. You pay closer to the spot price of gold. The spot price is what gold trades for on world markets right now. Dealers add a small premium to cover their costs. Bars have lower premiums than coins because they’re simpler to make.

Popular sizes include one ounce, ten ounces, and one kilogram. New investors often start with one-ounce bars. They’re affordable and easy to store. Larger bars work better for serious investors with more money to spend.

The Appeal of Rare Silver Coins

Silver coins offer something different from bars. They combine precious metal value with collectible worth. A rare coin might be worth much more than its silver content. Age, condition, and rarity all matter.

American Silver Eagles are the most popular silver coins. The government guarantees their weight and purity. Each coin contains exactly one troy ounce of 99.9% pure silver. The design features Lady Liberty on one side and an eagle on the other.

Older coins can be valuable collectibles. Morgan Silver Dollars from the 1800s attract serious collectors. Some rare dates sell for hundreds or thousands of dollars. Even common dates hold value because they contain almost an ounce of silver.

Silver costs less than gold per ounce. This makes it accessible for new investors. You can start with just a few hundred dollars. Many people buy a mix of both metals to spread their risk.

How to Buy Gold Bullion Bars Online Safely

Shopping online requires careful research. Start by choosing a reputable dealer. Look for companies with decades of experience. Check customer reviews on independent websites. Avoid dealers with lots of complaints.

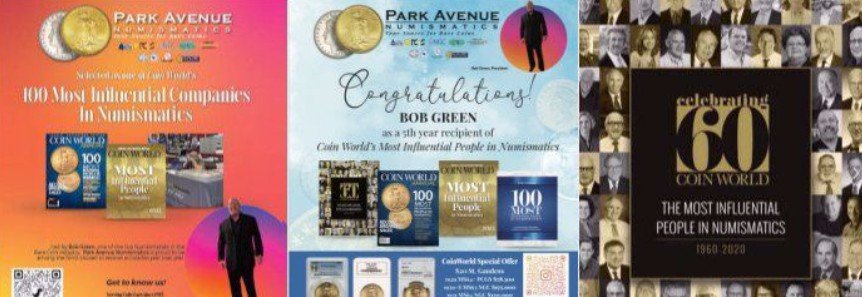

Park Avenue Numismatics has served customers for over 30 years. They specialize in rare coins and precious metals. Their secure website protects your personal information. They don’t share customer data with third parties. You can reach them at https://www.parkavenumis.com or call their toll-free number.

Compare prices from multiple dealers. Prices change based on the daily spot price. Add in the dealer’s premium and any shipping costs. Some dealers offer free shipping over certain amounts. Others charge based on order size.

Check the dealer’s return policy before buying. Reputable dealers let you return products within a set timeframe. Usually, this is seven to ten days. The products must remain in original packaging. This protects you if something arrives damaged.

Look for secure payment options. Credit cards offer buyer protection. Bank wires cost less in fees but can’t be reversed. Never send cash through the mail. Avoid dealers who only accept unusual payment methods.

Steps for Buying Rare Silver Coins Online

Buying rare coins takes more research than buying bullion. You need to understand coin grading. Professional services grade coins on a scale from 1 to 70. Higher numbers mean better condition. A coin graded MS-65 looks much better than one graded MS-60.

Learn about the coins you want. Study price guides to know fair market values. The PCGS Price Guide and NGC Price Guide are trusted resources. Compare prices across several dealers. Rare coin prices vary more than bullion prices.

Look at clear photos of the exact coin you’re buying. Reputable dealers photograph both sides. They show any problems or flaws. Be wary of dealers using stock photos. You might not get the coin shown in the picture.

Consider certified coins for valuable purchases. Third-party grading services seal coins in protective holders. The holder shows the grade and authenticates the coin. PCGS and NGC are the most trusted grading services. Certified coins cost more but offer peace of mind.

Park Avenue Numismatics offers both bullion and rare coins. Their experienced team can help you choose the right products. They handle everything from common Silver Eagles to rare collectible pieces. Their knowledge comes from three decades in the business.

Benefits of Online Precious Metals Shopping

Shopping online saves time. You don’t drive from shop to shop. You can compare prices in minutes. Many dealers offer better prices online than in physical stores. They have lower overhead costs.

Online dealers often have larger inventories. Physical shops have limited space. Online dealers can show thousands of products. You’ll find more variety in sizes, brands, and coin types.

Privacy matters to many buyers. Online shopping is discreet. Your purchases arrive in unmarked packaging. Neighbors don’t see you carrying out gold bars. Your financial decisions stay private.

You can shop any time of day. Browse at midnight if you want. Place orders on weekends. The website never closes. This flexibility helps people with busy schedules.

Potential Drawbacks to Consider

You can’t see products in person before buying. Photos help, but they’re not the same. You must trust the dealer’s description. This is why dealer reputation matters so much.

Shipping adds time and cost. Your order might take several days to arrive. Insured shipping for valuable metals isn’t cheap. Factor this into your total cost.

Online scams exist. Fake websites try to steal money. Always verify you’re on the real dealer website. Check the URL carefully. Look for security certificates. Stick with established dealers who have been around for years.

Returns can be complicated. You might pay return shipping costs. Some dealers charge restocking fees. Read all policies carefully before buying.

Key Points for Smart Buying

Price matters, but it’s not everything. The cheapest dealer might cut corners. Balance price with reputation and service. A few dollars more can buy peace of mind.

Start small if you’re new. Buy one or two coins or a small bar. Get comfortable with the process. Learn how your chosen dealer operates. Scale up as you gain confidence.

Store your metals safely. Consider a home safe or bank safe deposit box. Don’t tell everyone about your purchases. Security starts with discretion.

Keep all documentation. Save receipts, certificates, and packaging. You’ll need these if you ever sell. They prove authenticity and help establish value.

Understand the difference between numismatic and bullion value. Bullion products trade close to spot price. Rare coins trade based on collector demand. Know which type you’re buying.

Working With Established Dealers

Park Avenue Numismatics demonstrates what to look for in a dealer. They’re located in Miami, Florida, with a physical address at 5084 Biscayne Blvd. They use secure online processing for all orders. Customer privacy is their top priority. Three decades of experience means they’ve helped thousands of customers.

Established dealers stand behind their products. They have relationships with wholesalers and mints. This ensures authentic products at fair prices. They employ knowledgeable staff who can answer questions.

Look for dealers who are members of professional organizations. The Professional Numismatists Guild and American Numismatic Association set high standards. Members must follow ethical codes. This provides extra buyer protection.

Market Timing and Prices

Precious metal prices change constantly. Gold and silver trade like stocks. Prices move up and down throughout the day. You can’t predict exact movements. Nobody can.

Watch prices for a few weeks before buying. You’ll understand normal fluctuations. Don’t try to time the perfect moment. Focus on long-term value instead.

Dollar-cost averaging works well for metals. Buy the same dollar amount regularly. Maybe $500 every month. You’ll buy more when prices are low and less when prices are high. This averages out your cost over time.

Consider your goals before buying. Are you protecting wealth? Building a collection? Preparing for emergencies? Your goals should guide your purchases.

Final Verdict: Is Online Buying Right for You?

Buying gold bullion bars online and rare silver coins online makes sense for most people. The convenience can’t be beaten. Prices are often better than local shops. Selection is much larger.

But you must do your homework. Choose dealers carefully. Verify authenticity. Understand what you’re buying. Start small and learn as you go.

The internet has democratized precious metals investing. You don’t need to be wealthy to start. A few hundred dollars gets you in the game. Knowledge matters more than money.

Physical gold and silver still hold appeal in our digital age. They’re real assets you can hold. They’ve preserved wealth through wars, depressions, and currency collapses. Adding some to your portfolio makes sense.

Take your time. Research before you buy. Work with trusted dealers who have proven track records. Your first purchase is exciting. With the right approach, it can be the start of a valuable collection or investment portfolio.

About Park Avenue Numismatics

Park Avenue Numismatics brings over 30 years of experience to the precious metals industry. Located in Miami, Florida, they specialize in rare coins and bullion products. Their secure online platform and commitment to customer privacy have made them a trusted choice for collectors and investors nationwide.