Introduction

Buying rare gold bullion online has become easier than ever before. Collectors and investors now search for rare gold bullion for sale from trusted dealers who offer authentic pieces. The market for precious metals continues to grow each year. More people want to own physical gold that holds both monetary and historical value. Online platforms make it simple to browse collections from home. But finding the right dealer matters just as much as finding the right coin. Gold has protected wealth for thousands of years. Unlike paper money, it doesn’t lose value when governments print more currency. Rare gold pieces offer something extra. They combine the security of gold with collectible appeal. A rare coin from 1850 carries more value than its gold content alone. The history behind it matters. The condition matters. The scarcity matters. Smart buyers learn what to look for before they spend their money.

What Is Rare Gold Bullion?

Rare gold bullion refers to gold coins or bars that are hard to find. Most were minted decades or centuries ago. Some have low mintage numbers. Others survived in limited quantities. The term “bullion” means the item contains precious metal. But rare bullion is different from common gold bars you see everywhere. Common bullion includes modern American Eagles or Canadian Maple Leafs. Millions of these exist. Rare bullion includes coins like pre-1933 American gold coins. These pieces were recalled by the government in 1933. Many were melted down. The survivors became valuable. Other examples include old European gold coins, ancient gold coins, or limited-edition releases from government mints. The value comes from two sources. First, the gold content itself has worth. Second, the rarity adds premium value. A common one-ounce gold bar might sell for spot price plus a small markup. A rare 1907 Saint-Gaudens double eagle in excellent condition can sell for thousands above spot price. Collectors pay extra for history and scarcity.

Why Buy Rare Gold Bullion Online?

Shopping online offers major advantages over local coin shops. You get access to larger inventories. A physical store has limited shelf space. Online dealers can show hundreds or thousands of items. You can compare prices across multiple sellers in minutes. You shop on your own schedule without rushing.

Online dealers often have lower overhead costs. They don’t pay rent for expensive retail locations. These savings can translate to better prices for buyers. You also get detailed photos and descriptions. Most sites show both sides of each coin. They list the grade, mintage, and other important details. This transparency helps you make informed choices.

Privacy matters to some buyers. Online purchases arrive discreetly at your door. You don’t have strangers watching you buy gold at a shop. Reputable dealers use secure shipping with insurance. They also accept various payment methods including bank wires, checks, and credit cards. The entire process takes less time than driving to multiple stores.

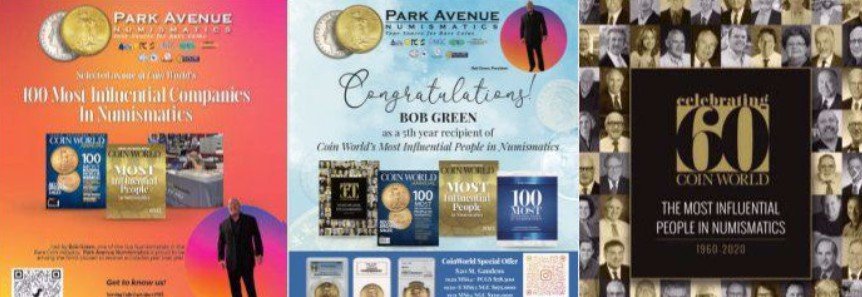

About Park Avenue Numismatics

Park Avenue Numismatics has served collectors and investors for years. The company specializes in rare coins and precious metals. They offer authenticated pieces with transparent pricing. Their website provides education resources to help buyers make smart decisions.

How to Choose Quality Rare Gold Bullion

Quality starts with authenticity. Fake gold coins exist in the market. Dishonest sellers try to pass off counterfeits as real. Work with established dealers who guarantee their items. Look for companies that have been in business for many years. Check their reputation through customer reviews and industry ratings.

Grading matters tremendously for rare coins. Professional grading services like PCGS or NGC examine coins and assign grades. A coin graded MS-65 (Mint State 65) is worth more than the same coin graded MS-60. The difference can be thousands of dollars. Higher grades mean better preservation and fewer flaws. When you buy rare gold bullion online, ask about grading. Certified coins come in sealed holders with the grade clearly marked.

Know what you’re buying before you click purchase. Research the specific coin or bar. Learn its history and typical price range. Understand mintage figures. A coin with only 5,000 minted is rarer than one with 500,000 minted. Check recent auction results to see what others paid. This research protects you from overpaying.

Consider your goals. Are you investing for wealth protection? Focus on coins with strong gold content and reasonable premiums. Are you building a collection? Look for historically significant pieces or complete sets. Some buyers want both investment value and collectible appeal. Pre-1933 American gold coins often fit this category perfectly.

Pros of Buying Rare Gold Bullion

Rare gold combines investment stability with growth potential. The gold content provides a floor value. Even if the rare coin market crashes, you still own physical gold. That gold has value anywhere in the world. The rarity factor can push prices much higher during strong markets. You get protection plus upside potential.

Historical significance adds appeal. Owning a coin from the Civil War era or the California Gold Rush connects you to history. These aren’t just metal discs. They’re artifacts that people held and used generations ago. That emotional connection makes collecting enjoyable beyond just financial returns.

Rare gold is portable wealth. A small coin can be worth thousands of dollars. You can store significant value in a safe deposit box or home safe. This portability matters during emergencies or relocations. Real estate can’t move. Gold coins can travel with you anywhere.

Tax advantages exist in some situations. In the United States, certain gold coins qualify for different tax treatment than regular investments. Consult a tax professional about your specific situation. But the potential for favorable tax treatment adds another benefit.

The market for rare gold remains active. When you want to sell, buyers exist. Major dealers, auction houses, and private collectors all purchase quality rare gold. Liquidity isn’t guaranteed for every single coin, but established rare coins sell readily. This beats trying to sell obscure collectibles that few people want.

Cons of Buying Rare Gold Bullion

Higher premiums over spot price can surprise new buyers. That 1893 Liberty Head half eagle costs more than its gold weight suggests. Sometimes much more. You pay for rarity and condition. This premium must be justified by your collecting goals or investment strategy. If you only want gold exposure, common bullion makes more sense.

Knowledge requirements are real. Rare coins demand research and education. You need to understand grading, authenticity, and market values. Mistakes cost money. Buying the wrong coin at the wrong price hurts your portfolio. Spend time learning before spending money on purchases.

Liquidity can vary by coin. Popular rare coins like Saint-Gaudens double eagles sell quickly. Obscure foreign gold coins might sit unsold for months. Know the market for your specific items before buying. Don’t assume every rare coin has eager buyers waiting.

Storage and insurance add costs. Rare gold deserves proper protection. A safe deposit box costs money. Home insurance might not fully cover rare coins. You may need additional collectibles insurance. These ongoing costs reduce your net returns.

Market timing affects results. Rare coin prices fluctuate based on collector demand. Economic conditions matter. Auction results influence prices. You might buy at a market peak and watch values decline for years. Patience and long-term thinking help, but short-term price drops can be uncomfortable.

Where to Find Rare Gold Bullion for Sale

Park Avenue Numismatics offers an extensive selection of authenticated rare gold pieces. Their website at https://www.parkavenumis.com/ provides detailed listings with clear photos and descriptions. The company maintains competitive pricing and prioritizes customer education. They explain what makes each piece valuable and help buyers understand their purchases.

Other reputable online dealers exist in the market. Heritage Auctions runs regular coin auctions with rare gold offerings. APMEX carries both common bullion and select rare pieces. Great Collections operates an online auction platform for coins. Each has different strengths and inventory focuses.

Compare prices across multiple sources before buying. The same coin can vary in price by hundreds of dollars between dealers. Factor in shipping costs and payment method fees. Some dealers charge more for credit cards but less for bank wires.

Watch for sales and special offers. Dealers occasionally discount inventory to move specific items. Email lists and social media channels announce these deals. But don’t buy something just because it’s on sale. Make sure it fits your collection or investment plan.

Final Verdict

Buying rare gold bullion online makes sense for patient, educated investors. The combination of precious metal value and collectible appeal creates unique opportunities. You need knowledge, research skills, and realistic expectations. But the rewards can exceed those of common bullion alone. Choose dealers carefully based on reputation, transparency, and service. Companies like Park Avenue Numismatics provide the expertise and inventory that serious buyers need. Their commitment to authenticity and education protects customers from costly mistakes. Start your journey with clear goals. Know whether you’re investing, collecting, or both. Buy quality over quantity. One excellent rare coin beats ten mediocre common pieces. Protect your purchases with proper storage and insurance. Stay informed about market conditions and price trends. Rare gold bullion offers a tangible connection to history while preserving wealth. The market rewards those who take time to learn and choose wisely. With the right approach, these beautiful pieces can become both financial assets and cherished heirlooms.